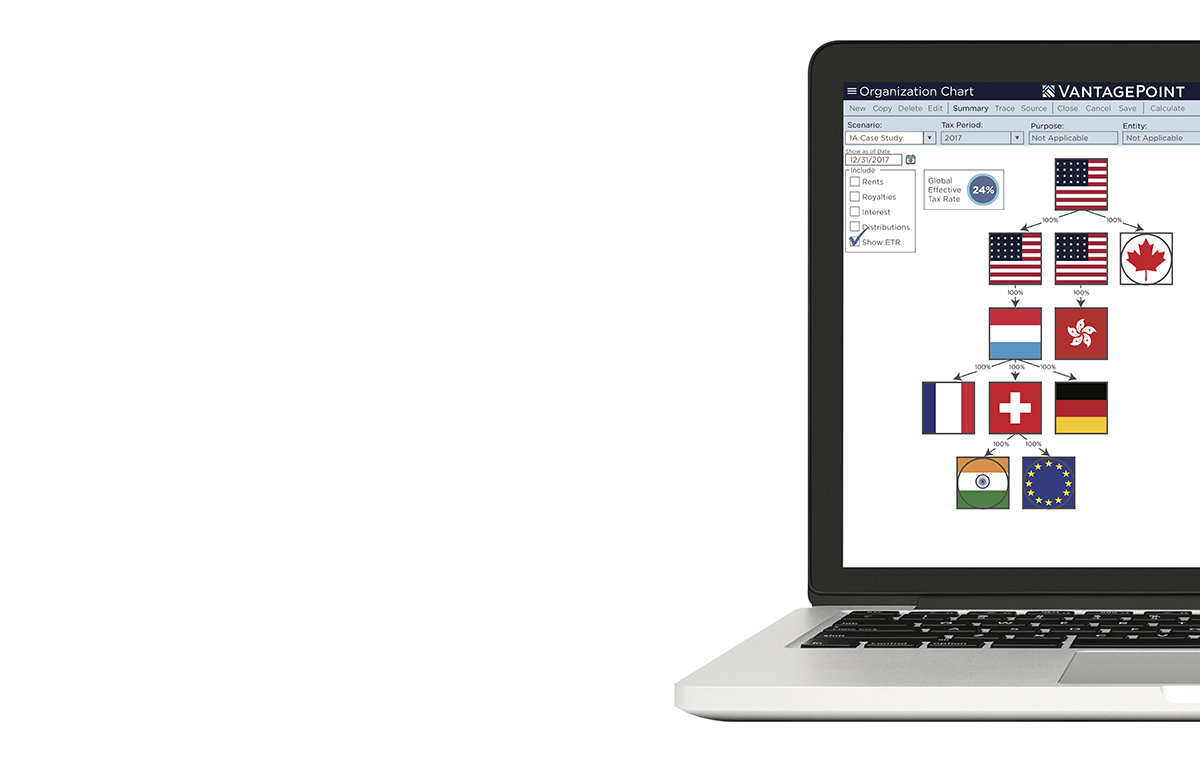

Discover the power of fully integrated Global Tax calculations

VantagePoint™ Global Tax Software integrates GILTI, FDII, Sub F, FTC, IC-DISC, BEPS, BEAT, Pillar Two calculations and more.

VantagePoint™ is utilized on consulting and co-sourcing engagements and is also available for license.

Resources

The most advanced international tax planning and forecasting tool.

Unlike traditional compliance software, VantagePoint focuses primarily on global tax optimization, achieving superior overall results.