The most advanced international tax planning and forecasting tool.

Unlike traditional compliance software, VantagePoint focuses primarily on global tax optimization, achieving superior overall results.

The most advanced international tax planning and forecasting tool.

Unlike traditional compliance software, VantagePoint focuses primarily on global tax optimization, achieving superior overall results.

Easily Quantify the Impact of Change

Comprehensive & Fully Integrated

VantagePoint’s cloud-based platform makes it ideal for client teams and their advisors to collaborate on a real-time basis.

What-if Planning & Optimization

VantagePoint makes it easy to quantify changes in legal structure, entity classification, transfer pricing, and 861-8 methodology.

Side-by side comparison reports can be exported into Excel along with the related Audit Trail Reports.

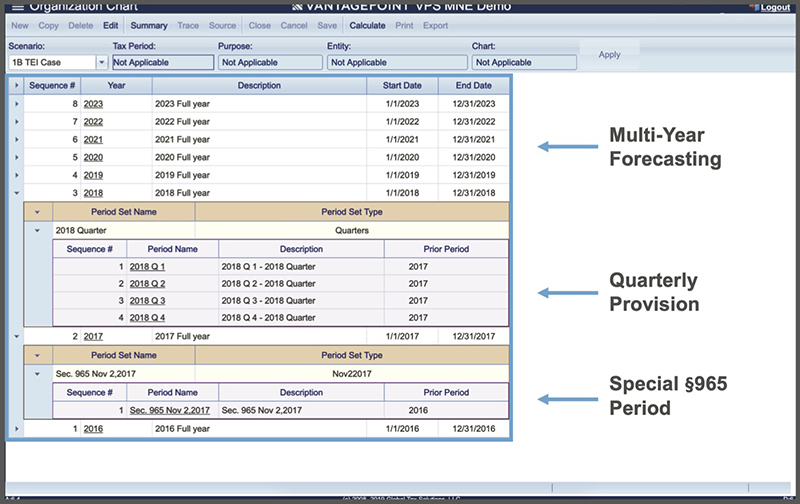

Forecasting & Provision

VantagePoint is parameter driven, making it easy to adapt to new laws, such as for §250 and §163(j).

Get accurate results when time is limited, such as during provision analysis, multi-year forecasting, and acquisition planning.

VantagePoint Demo Booklet

Learn why clients are calling VantagePoint “a lifesaver” this past tax season in this detailed booklet, which illustrates and explains some of the most important features of the software.

The interdependence of the GILTI, FDII and Foreign Tax Credit calculations, together with a heightened focus on base erosion and transfer pricing, requires a far more sophisticated tool that is capable of adapting to a dynamic global tax environment.

VantagePoint provides a centralized data hub that simultaneously integrates transfer pricing analytics and comprehensive international tax calculations.

Improve Processes & Optimize Tax Savings

VantagePoint’s accelerated TCJA implementation plan provides the client with a side-by-side comparison, reconciling with their provisional estimates.

Using a single integrated global tax database, clients can run multiple “what-if” scenarios to fully refine and optimize their overall results, including GILTI and FDII.

Capabilities

- Global Intangible Income

- Foreign Earnings & Profits

- Foreign Tax Credit

- Transfer Pricing, BEPS & BEAT

- IC-DISC

- DPAD

- Tax Forms

- Global Tax Analytics

Modeling your own information in VantagePoint is the best way to demonstrate its value.

Features

Global Tax Analytics

Simply perform “what-if” analysis on any number of alternative scenarios.

E-file Forms

VantagePoint’s e-fileable international tax forms are IRS-approved and compatible with tax compliance

software.

Form 1118

Form 1118 Regular

Form 1118 Schedule I

Form 1118 Schedule J

Form 1118 Schedule K

Form 1120

Form 1120 Schedule G

Form 1120 Schedule M-3

Form 1120 Schedule N

Form 1120-IC-DISC

Form 1120-IC-DISC Schedule K

Form 1120-IC-DISC Schedule P

Form 1120-IC-DISC Schedule Q

Form 4562

Form 4797

Form 5471

Form 5471 Schedule E

Form 5471 Schedule H

Form 5471 Schedule I-1

Form 5471 Schedule J

Form 5471 Schedule M

Form 5471 Schedule O

Form 5471 Schedule P

Form 5472

Form 5713

Form 5713 Schedule A

Form 5713 Schedule B

Form 5713 Schedule C

Form 8404

Form 8594

Form 8621

Form 8832

Form 8833

Form 8858

Form 8858 Schedule M

Form 8865

Form 8865 Schedule G

Form 8865 Schedule H

Form 8865 Schedule K-1

Form 8865 Schedule O

Form 8865 Schedule P

Form 8886

Form 8903

Form 8975

Form 8975 Schedule A

Form 8990

Form 8991

Form 8992

Form 8993

Form 926

Form 965

Form 965 Schedule A

Form 965 Schedule B

Form 965 Schedule C

Form 965 Schedule D

Form 965 Schedule E

Form 965 Schedule F

Form 965 Schedule G

Form 965 Schedule H

Form 965-B

Access and Control

Benefit from unlimited system access throughout the implementation process.

Client-Driven Service

Whether a client has access to VantagePoint through a consulting engagement or a full license, Forte customizes its service level to meet each client’s specific objectives.

Data Security

SOC 1 Type 2

SOC Type 2

Features

Global Tax Analytics

Simply perform “what-if” analysis on any number of alternative scenarios.

Access and Control

Benefit from unlimited system access throughout the implementation process.

E-file Forms

VantagePoint’s e-fileable international tax forms are IRS-approved and compatible with tax compliance

software.

Client-Driven Service

Whether a client has access to VantagePoint through a consulting engagement or a full license, Forte customizes its service level to meet each client’s specific objectives.

Modeling your own information in VantagePoint is the best way to demonstrate its value.

Client-Driven, Customized Service

Forte customizes its service level to meet each client’s specific objectives. Some clients simply license the software and run independently after their initial implementation and training. Other clients prefer for the firm’s professionals to produce the desired deliverable on a turnkey basis. Yet others have Forte do most of the heavy lifting relating to specific deliverables, but want full access to VantagePoint for ad hoc planning and reporting.

Most frequent questions and answers

Forte combines international tax expertise in conjunction with the most advanced, versatile, and powerful global tax software tool in the industry.

Forte focuses specifically on those areas of international taxation that have the greatest impact on U.S.-based multinationals and exporters.

VantagePoint™ provides a centralized data hub, which helps companies manage their global tax position throughout the year.